Contents

1. Introduction

Accepting Bitcoin payments on your website has never been easier. This ultimate guide will walk you through how to set it up, what options to consider, and what to look out for.

Unless you’ve not been following the developments on the Internet for the last several years, you’ve probably heard about Bitcoin (BTC), a sort of digital money that removes the middlemen (governments and financial institutions) and allows parties to interact directly with one another. This, combined with Bitcoin being used to purchase goods and services anonymously, makes BTC an appealing payment alternative for many individuals.

And, if you’re like other e-commerce retailers, the buzz surrounding Bitcoin has encouraged you to inquire. Should you begin to take Bitcoin payments? How do you go about it? What is Bitcoin‘s future?

2. Advantages of Using Bitcoin for Payments

The first question that you might ask here is why do e-commerce websites need to integrate Bitcoin into their infrastructure. Bitcoin has some distinct advantages, but the three most important advantages for e-commerce companies are as follows: a) BTC does not support chargebacks, b) Bitcoin has zero to low transaction costs, and c) adopting BTC makes a company more appealing to a specific class of customers.

a. No Chargebacks

Many of the customers attempt fraud by using the chargeback clause. They steal both the product and the money. That is why conducting an online business can be a nightmare for some online stores. But that is not the case in BTC payments. Bitcoin transactions, unlike credit card transactions, are irrevocable. Without the merchant’s permission, the party that submitted the payment cannot reclaim the money once they have been transferred. This reduces your chargeback expenses and makes it more difficult for customers to attempt e-commerce fraud.

b. Low Transaction Costs

There are cases when online businesses stop their operations in many countries because of high transactions. In some cases, vendors are even banned from conducting business in some countries. By using BTC, both the customers and the vendors can surpass these barriers. As previously stated, governments and financial intermediaries have no control over Bitcoin. Transactions take place directly between the buyer and seller, so there are no middlemen to hold your cash, and the costs (if any) for processing BTC payments are cheaper than those for credit cards.

c. Customer Appeal

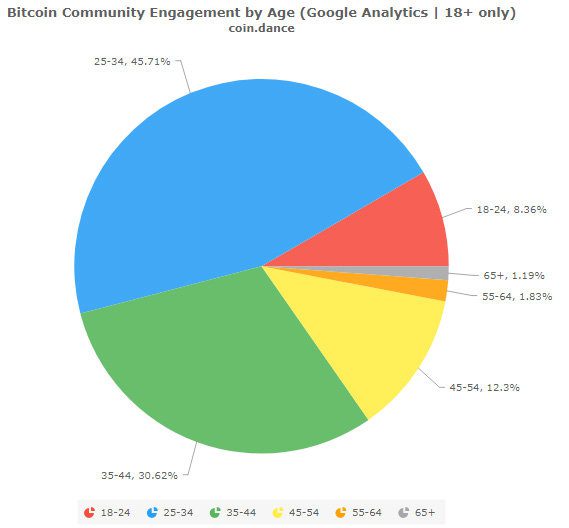

Merchants may expand their consumer base by accepting Bitcoin. As an increasing number of people begin to utilize Bitcoin to purchase products and services, embracing the digital currency might be just what you need to set yourself apart and entice them to select you. To be more specific, the bulk of Bitcoin users appear to be between the ages of 25 and 34. However, as Bitcoin acceptance grows, we should anticipate these demographics to widen.

3. How To Accept Bitcoin on Your Website

Now, that we have established how Bitcoin can be helpful for your e-commerce website, let us discuss how you can use it for your ease and convenience. Here are a few steps that you can follow to step up Bitcoin:

a. Magento & Shopify Examples

If you already have an e-commerce site, you may integrate it with a Bitcoin payment processor to get started right away. Most e-commerce systems already have established integrations, making it considerably easier to set up Bitcoin payments.

Magento e-commerce retailers, for example, have choices such as BitPay, CoinGate, and others. Meanwhile, Shopify store owners may take Bitcoin payments using BitPay, Coinbase, Dwolla, or GoCoin.

Finding a Bitcoin processor on certain e-commerce platforms may be as simple as looking for integration in the platform’s marketplace (this is the case for Magento) In other circumstances, you may need to consult your e-commerce platform’s support documentation to learn how to receive Bitcoin payments.

When in doubt about where to start, contact your e-commerce or web agency. You would also need to contact your account manager for more information on how to link your store with a Bitcoin payment processor.

b. WooCommerce Example

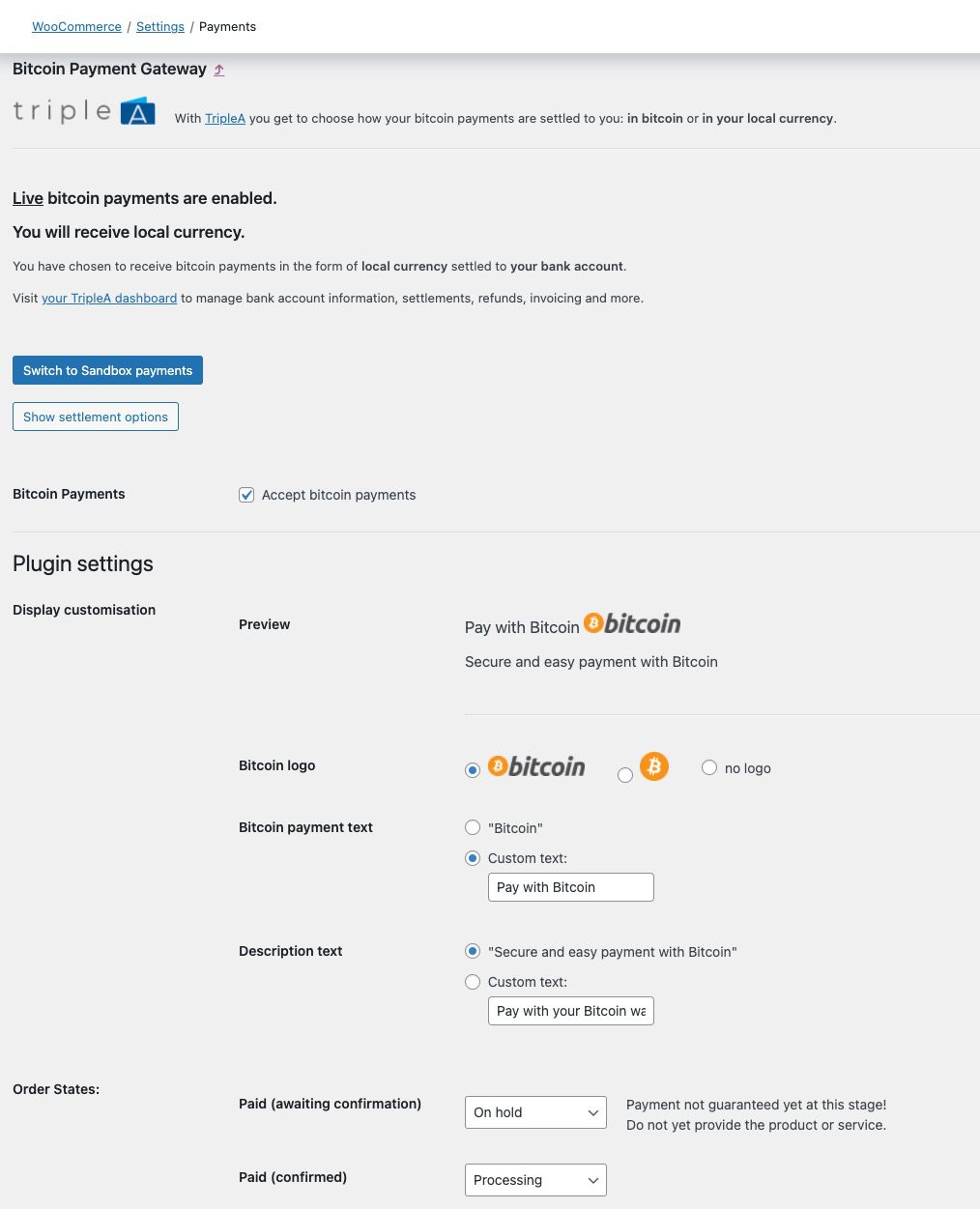

When we setup Bitcoin payments for VP Racing Fuels, we used a TripleA. It is a WordPress/WooCommerce integration through an easy-to-use plugin that helps users to choose a user-friendly approach in online trading.

Once you set up your account and create a wallet, the rest of the setup is easy. They also offer and accept multiple cryptos, such as Ethereum (ETH), Cardano (ADA), Polkadot (DOT), and others. You can choose how you want to settle your payment and convert the crypto to your local currency to reduce volatility in the price exchange. Their exchange fees are reasonable at 0.8%.

The Triple A plugin settings in WordPress.

c. How to Choose a Bitcoin Payment Processor

The next step is to compare the many BTC payment processors available to find which one works best for your shop. Here are some things to think about:

Payout frequency — Some companies offer daily payouts, while others may take up to three days. If payout frequency is crucial to you (for example, if you must pay charges tied to purchases that might add up fast on busy days), talk to your processor about it.

Currency support — Check to see if your Bitcoin payment processor supports the payout currency you desire. Most solutions allow businesses to withdraw Bitcoin payments in US dollars and GBP, but if you want to withdraw cash in a different currency, be sure the service supports it.

Countries supported — Some Bitcoin processors cannot service businesses from particular countries, so be sure your supplier covers the country in which you conduct business.

Customer support — If you have a lot of queries or believe you’ll need assistance setting up BTC payments, look into your payment processor’s customer service options. Is phone assistance available, or is everything handled through email? How about a live chat? Consider the means that best suit your eCommerce needs.

d. What if Bitcoin Payments Are Not Available on Your Web Platform?

The simplest approach to take Bitcoin on your eCommerce site is to integrate a Bitcoin payment provider. If a direct integration is not possible, you can look at alternatives such as:

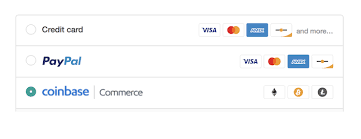

Payment buttons – You may be able to add a payment button to your website if you use a Bitcoin payment processor. Coinbase, for example, includes a button generator that makes this simple. You may also generate Bitcoin buttons using the Coinbase API.

Image courtesy of cryptocurrencynews.com

Custom integration – While we’re on the subject of APIs, if you know a web developer and can’t find a Bitcoin solution that directly links with your shopping cart, you may take the custom integration route. You may accomplish this with the API documentation provided by several suppliers.

Invoices – An alternative to shopping carts is to utilize invoices. Your Bitcoin payment provider will determine how to create invoices. To generate invoices for GoCoin, you may use its API; Coinbase, on the other hand, includes an invoice generation application.

You should also verify with your existing invoicing solution to determine if Bitcoin payments are supported (or if they have any workarounds for the cryptocurrency). QuickBooks users, for example, can use Intuit Labs’ Pay by Bitcoin service. Depending on the merchant, the invoicing and payment process will differ. Some businesses may wait until the invoice is paid before shipping the items. Others may prefer to use words like Net 30. If you opt to use invoicing, figure out what works best for your company and go from there.

Workarounds – If you are unable to make Bitcoin work through integrations, buttons, or invoices, you may opt to discover a solution. Perhaps it requires requiring the buyer to contact you personally to make a BTC purchase. You might request that customers leave a particular message at the checkout (for example some marketplace sellers do this; you may see it on sites such as Etsy).

4. Transaction Security

If you have decided to use Bitcoin as your mode of payment, you need to make sure that your system is safe and secure. Funds are hard-earned and precious and no one wants to lose them to scammers.

Here is a Bitcoin payment security checklist for you to consider:

- Keep up with the latest news related to cryptocurrency — Don’t forget to keep your software up to date. Make sure you’re always utilizing the most recent version of any Bitcoin wallets, applications, or solutions you have so you can keep up to current on security and stability changes.

- Use secure passwords and two-factor authentication – Use a strong, difficult-to-guess password (or, better yet, a passphrase) that incorporates a combination of upper and lowercase letters, digits, and special characters to protect your money. If the solution you’re using supports multi-factor authentication (for example, requiring you to input a code given through SMS or email), use it.

- Backups – Backups can assist protect your cash in the event of a security breach (for instance, if someone hacks into your system or if your device gets stolen or broken into). Bitcoin.org suggests the following backup strategies for the greatest results:

- Backup your whole wallet — Some wallets employ a large number of concealed private keys internally. If you just have a backup of the private keys for your visible Bitcoin addresses, you may not be able to retrieve a significant portion of your assets.

- Encrypt internet backups — Any backup kept online is extremely vulnerable to theft. Malicious malware can infiltrate a machine that is linked to the Internet. Encrypting any backup that is exposed to the network, as a result, is a solid security practice.

- Use many secure sites — single points of failure are insecure. If your backup is not reliant on a single place, any catastrophic occurrence is less likely to prevent you from recovering your cash. You might also want to think about utilizing alternative media, such as USB keys, paper, and CDs.

- Make frequent backups – You must back up your wallet regularly to ensure that any current Bitcoin address changes and new Bitcoin addresses you establish are included in your backup. However, shortly, all applications will use wallets that only need to be backed up once.

- Consider cold storage – Cold storage is the practice of storing a Bitcoin wallet offline. This safeguards your cash in the case of a digital breach.

- Don’t put too many funds in your wallet — remember, hackers and scammers cannot steal what isn’t there. Make a habit of transferring monies offline or converting them to your local currency so that you may keep them in your (insured) bank account. If you require Bitcoin to run your business, retain only what you require at any one moment.

5. Customer Policies

Because Bitcoin is still relatively new and innovative, your consumers are going to have some questions. Save time and relieve concerns by properly expressing your Bitcoin payment procedures on your website from the start. The specifics of your policy will, of course, depend on your business, but some things to consider are:

- Payment method — Describe how paying with Bitcoin will function on your website. What actions should clients take if they wish to pay using Bitcoin? What information would they be required to supply? To reduce inquiries, layout the method as clearly as possible.

- Refunds, exchanges, and returns — Will you allow customers to exchange or return Bitcoin-purchased items? What if someone requests a refund? And how will customers interact with you? Remember that Bitcoin transactions are irrevocable, thus disgruntled consumers cannot issue chargebacks. Also consider that the price of BTC fluctuates, so if you are going to return BTC it could be worth more at the time of the return vs. the original purchase (if you did not convert to your local currency).

- Consider how you intend to deal with these issues. Whether you opt to provide refunds in BTC, local money, or shop credit/gift cards, make sure your processes are as straightforward as possible.

- Limitations – Are there any limits for consumers who pay using Bitcoin? Are Bitcoin payments accepted for all of your products and services? If not, make a note of which things aren’t accessible for purchase using BTC.

6. The Future of Bitcoin

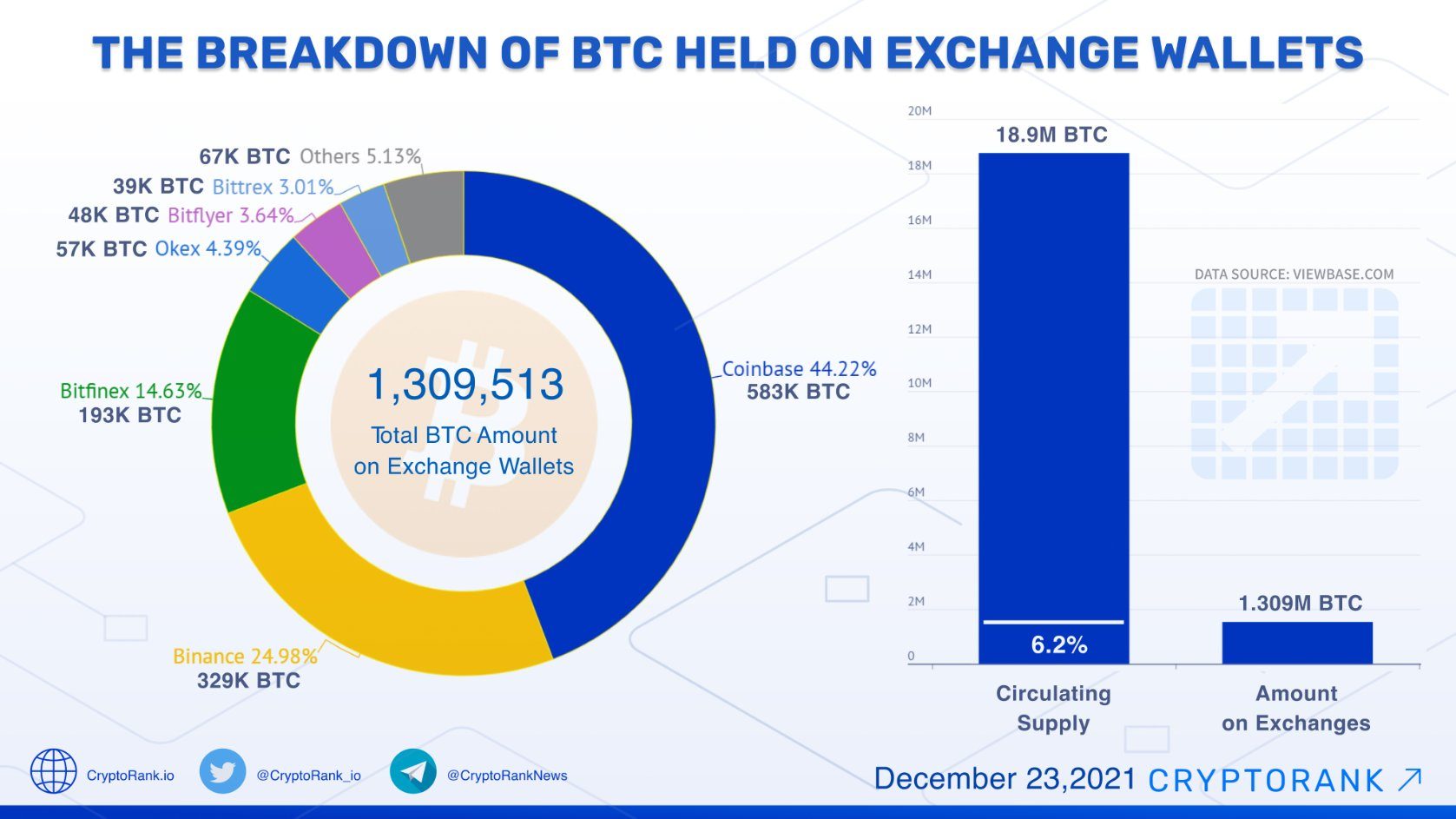

If you follow the crypto market, you know the volatility these coins can have. According to Bloomberg, just 1,000 wallets own 40% of all coins, so these “whales” can single handedly disrupt a trillion dollar market. Bitcoin is often referred to as a “store of value” asset, and is not currently built to be transactional. Only 6.3% of the total Bitcoin supply is left on exchanges (about 1.3 million BTC), meaning the rest is locked up in cold storage. Just to put some perspective on this, Visa can handle roughly 65,000 transactions per second, whereas Bitcoin can only handle about 7 transactions per second. The Bitcoin proof-of-work validation system for blockchain transactions is just too slow for the world’s needs. This is why other coins such as Ethereum (ETH), Cardano (ADA) and Ripple (XRP) are much better suited for lighting-fast transactions at-scale, cross-border transactions, and more real-world scenarios.

Should you still bother with accepting crypto on your website? Sure, we think so, especially if you have an early-adopter customer base. According to a study done by the New York Digital Investment Group, in 2021 roughly 22% of the US adult population owns some Bitcoin, which was up from 6% in 2020. So it’s growing fast, and it’s a way to look more “technically advanced” than your competition.