Hubspot successfully analyzed over 1 million websites, 1 million Twitter accounts, raised another $16 million, and yet they only have 1750 customers.

Did anyone else notice this?

I’ve always been impressed with Hubspot, and I have much admiration for Dharmesh Shah and the other founders. I’ve read just about all of their stuff on inbound marketing, permission marketing, conversion tracking and other juicy stuff. But I was shocked to read the news about their $16 million in additional funding with less than 1750 total customers. Boy, with all of the inbound marketing webinars and conversion improvement whitepapers, it seems as though Hubspot may need to eat more of their own dog food. Don’t get me wrong – their customer growth rate looks like the “hockey stick” we would all love to have, and a 350% growth rate in revenue is not too shabby – but I expected more than 1,700 customers. And it looks like it takes 2-3 months to acquire 250 new customers, some of which will churn I would imagine.

After the first two rounds of funding, they’ve essentially spent $10,000 to acquire each new customer, but as you will see further below, their average annual sale is only about $6,000. As good as their product might be, I’m sure they are not counting on customers sticking around for 20 months so they can break even, so they will need to sign up more customers faster than ever to decrease their cost per acquisition and get this thing profitable – and fast. This is the risk by taking on so much funding – how much runway do I need to get our cost per acquisition down and our lifetime value up? They spent the first $17 mil on engineering the product, perfecting it, building brand awareness, positioning themselves as experts with endless whitepapers, webinars, videos and more, and understanding the model to where they could go and raise more money. Surely they know for every dollar they put into inbound marketing efforts, how much revenue and profit they will get on the backend.

Now, since this is their third round of funding, their gong to have to sell for about 10X their current value so the first two VC’s get their money out of the deal, at least so I am told. Wow! An “SEO Company” for $335 million? I suppose they could always go public. Remember when Rackspace (NYSE: RAX) did that last year? I’m sure being in a niche space where comparisons are hard to come by makes it difficult for analysts to evaluate the company, and even harder for investors to invest in.

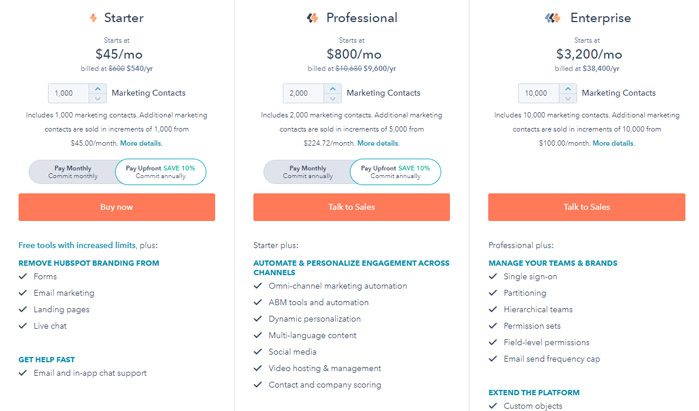

So if a customer today is costing them around $10,000, but they are only getting $6,000 per year per customer on average, how long will this model last? Let’s take a look at their pricing model that is directly from their website:

If you segment customers across this type of pricing model, or a “freemium” pricing model, you will find that most of them are in the low to mid tiers, with a handful at the top tier. You spend most of your time trying to figure out how to upsell and convert your lower-tiered customers up into your higher profit top tiers. Let’s assume Hubspot has a 60-20-20 split here from low to high. So of their roughly 1,750 customers, that would put 1,050 at the low tier, 350 at the mid tier, and another 350 at the top tier. If you do the math, that’s a little over $10.5 million in annual revenue, or $6,000 per customer per year, on average.

Hubspot claims an annual revenue growth rate of 350%, which to get to the $300 million mark is going to take about 2-3 years, assuming the growth is constant and they can get to about 50-60,000 customers. So as you can see, the 250 new customers every 2-3 months isn’t going to cut it – they will likely need to get to around 750-1,000 new customers every month.

The guys at Hubspot are surely savvy enough and have enough brain power (and resources now) to pull this off, but it seems it will be a helluva feat. Is Hubspot the next SalesForce? Will they have to go public? It seems like Hubspot is in the right position for extreme growth – a refined product, brand recognition, a seasoned team, cash in the bank – how could they go wrong?

Best of luck to ya, Hubspot.

Update 10/26/09: I just found this great blog post by Ben Yoskovitz: Raising Startup Capital is an Achievement, But Not the Most Important One. He explains that Dharmesh is more of a “bootstrap guy” versus a venture capital guy, where he states “Closing a funding round is not value creation. It’s the opportunity to create value.” – I happen to agree with Dharmesh on that 110%. After you get your funding – whatever round or stage it is in – that’s when the real work begins.